The requirement to file a Suspicious Transactions Report and/or Suspicious Activity Reports (STR/SAR)

with the Financial Intelligence Unit (FIU) of the UAE is contained in UAE Federal Law No. 20 of 2018 and

Cabinet Decision No. 10 of 2019 (‘Federal AML Legislation’). This Federal AML Legislation applies

directly to all SCA regulated entities in accordance with SCA Board of Directors Decision no. 21 of 2019

concerning procedures for Anti-money laundering and combating the financing of terrorism and illegal

organizations.

Apart from filing STR/SARs, entities are advised to provide any additional information required in

relation to them, and also to put in place indicators that can be used to identify the suspicion of a

crime involving ML/FT and to update those indicators on an ongoing basis, as well as in keeping with

relevant developments concerning ML/FT typologies. In order to fulfil these obligations, regulated

entities should implement adequate internal policies, procedures and controls in relation to the

identification and reporting of suspicious transactions. Regulated entities should also consider the

results of both the NRA and their own ML/FT risk assessments in this regard.

GoAML System:

Entities are required to report STR/SARs directly to the FIU using the “GoAML” portal. Registration on

the GoAML portal is mandatory for all licensed entities regulated by SCA immediately after receipt of

their SCA license. Even in case of a licensed entity being regulated by another financial regulatory

authority in the UAE and registered on the GoAML portal under such other regulatory authority, it has to

register itself again as an SCA regulated entity. Moreover, the FIU releases its periodic Trends and

Typologies Reports on the GoAML system, which contain valuable guidance for regulated entities on

identification of suspicious transactions based on an analysis of filed STRs/SARs.

The objectives of the GoAML system are for the FIU to:

- Strengthen its capability to meet and discharge its legislative objectives and functions;

- Ensure that the UAE’s financial system stays relevant and effective in the fight against money

laundering and terrorism financing;

- Collaborate more effectively with various stakeholders such as reporting entities, supervisory

bodies and law enforcement agencies and;

- Standardize and streamline all reporting requirements and ensure that the UAE is aligned with the

Anti-Money Laundering and Combatting of TerroristFinancing AML/CTF standards of the Financial

Action Task Force (FATF).

Registration

The SCA in its capacity as the regulatory authority for AML/CTF procedures for the capital market sector

in the UAE is the Supervisory Body for approving:

- pre-registrations to allow SCA regulated entities to gain access to the GoAML portal; which

can be done through the following link: Click here

- Registrations of SCA regulated entities on the GoAML portal (after completing the

pre-registration stage) which can be done through the following link: Click here

Record Keeping

Entities are required to retain all records and documents pertaining to STRs and the

results of all analysis performed. Such records relate to both internal STRs and those filed with the

FIU, and include but are not limited to:

- Suspicious transaction indicator alert records, logs, procedures done to confirm suspicion,

recommendations and decision records, and all related correspondence;

- Competent authority request for information and their related procedural files and correspondence;

- Customer due diligence and Business Relationship monitoring records, documents and information

obtained in the course of analyzing or confirming potentially suspicious transactions, and all

internal or external correspondence or communication records associated with them;

- STRs (internal and external), logs, and statistics, together with their related analysis,

recommendations and decision records, and all related correspondence;

- Notes concerning feedback provided by the FIU with respect to reported Suspicious Transactions, as

well as notes or records pertaining to any other actions taken by, or required by, the FIU.

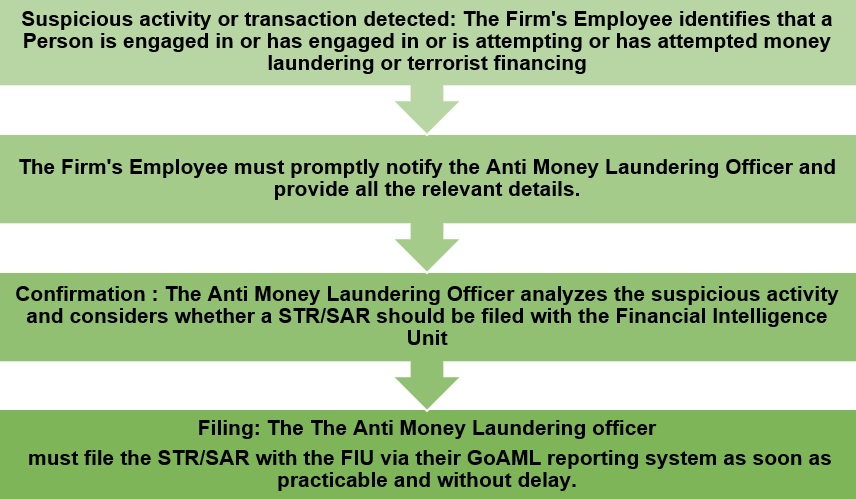

The following

process provides licensed entities with guidance on the STR/SAR submission process:

Enquiries

Entities can contact the SCA AMLTF Section for any GoAML related enquiries on the email.

However, GoAML is a FIU hosted IT system and therefore, for technical support, entities are advised to

contact the Technical Team at the FIU at the email